Partial Disposition Roof Replacement

The practice unit notes that identifying that a taxpayer elected to take a partial disposition of a building is the first step in determining whether it is compliant with the code sec.

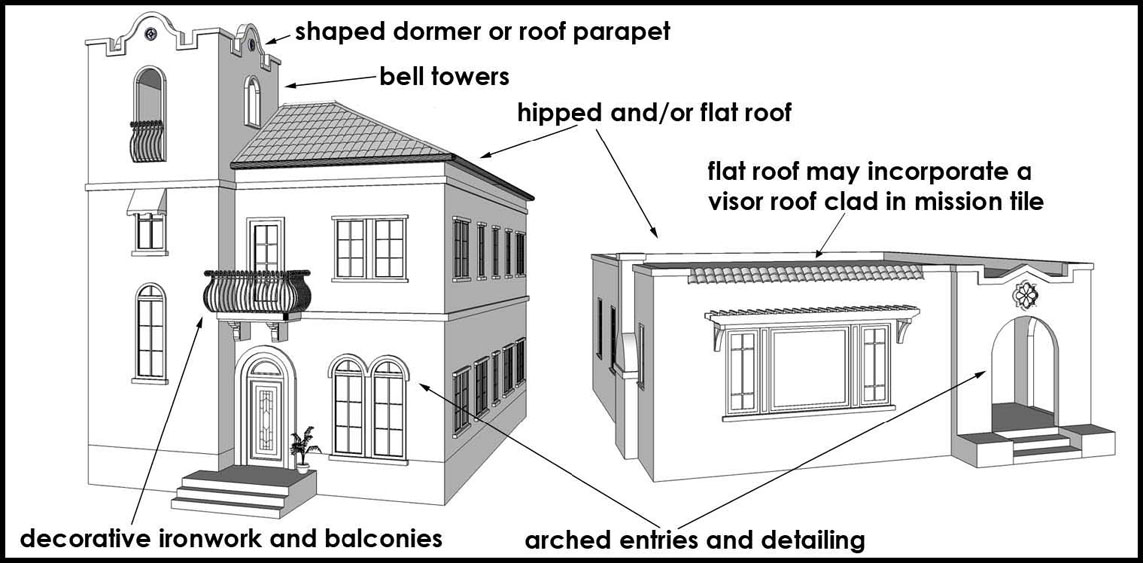

Partial disposition roof replacement. A roof system includes a roof structure and multiple layers of materials above it. Renovation or remodeling projects that give rise to significant partial disposition losses and removal cost deductions often are multimonth or even multiyear projects and demolition of the existing property generally is completed early or at the very beginning of the project. Certain betterments restorations or adaptations to property can provide you with a tax opportunity to do a partial disposition of the old property and capitalize the new property. She replaces the roof which is a structural component.

An this can result in still other tax advantages. Alice may not recognize a loss and must continue to depreciate the retired old roof unless she elects to treat the roof retirement as a partial disposition of the building. Calculating partial asset. The kbkg partial disposition calculator is designed to make calculations as simple as possible while minimizing unnecessary work.

In other words a current partial disposition lets you write off an old roof you replaced in 2014 on the 2014 tax return. How to calculate partial dispositions. We have national coverage in that we can do a cost segregation study on any building in the us. For example a loss could not be recognized when an old roof was disposed and replaced with a new roof.

But a late partial disposition lets you write off an old roof you replaced in say 2012 on the 2014 tax return. Treasury regulations provide guidelines for recognizing gain or loss on the disposition of macrs property as well as rules for the partial dispositions of assets regs. Replacing a substantial portion of any major component of a building meets the criteria of a capital improvement. The accounting mechanics work the same for a late partial election.

A roof system is a major component because it performs a discrete and critical function in a building structure. Free partial asset disposition calculations for as long as you own the building when the property owner completes a cost segregation study through carrara business services. One of the issues on its radar is the partial disposition election for buildings and its structural components. The election is made by reporting the gain or loss on a timely filed original tax return including extensions for the tax year in which the portion of.

By providing basic data the calculator provides a ppi adjusted value while considering the condition of the respective component at the time it was acquired accomplished by considering the component s normal life.